“With revenue-based availability, we’re incentivized to optimize revenue”

Madrid / 16 December 2020

Why Revenue Based Availability makes sense.

An interview with Juan Gutierrez, CEO of the Service Business Unit at Siemens Gamesa, on how the company is helping its customers navigate the end of subsidies.

Do you have interesting topics for our renewable energy journal? Are you interested in renewable products made by Siemens Gamesa? Or are you thinking about joining our team? Please do not hesitate to contact us.

info@siemensgamesa.comQ: The marketplace environment for customers is evolving rapidly, with support mechanisms beginning to fall away in some markets for both new unit and legacy installations. What impact will this have on electricity providers and the companies that support them?

A: Up to now, the focus of the wind industry has been lowering the cost of electricity. We set ourselves on a journey to compete with conventional production methodologies such as Oil & Gas and coal, and, to a large degree, we’ve succeeded. As an industry, we currently dedicate hundreds of millions of euro to chasing these sought-after low-cost levels for a produced kWh – and there’s still value in doing this, of course.

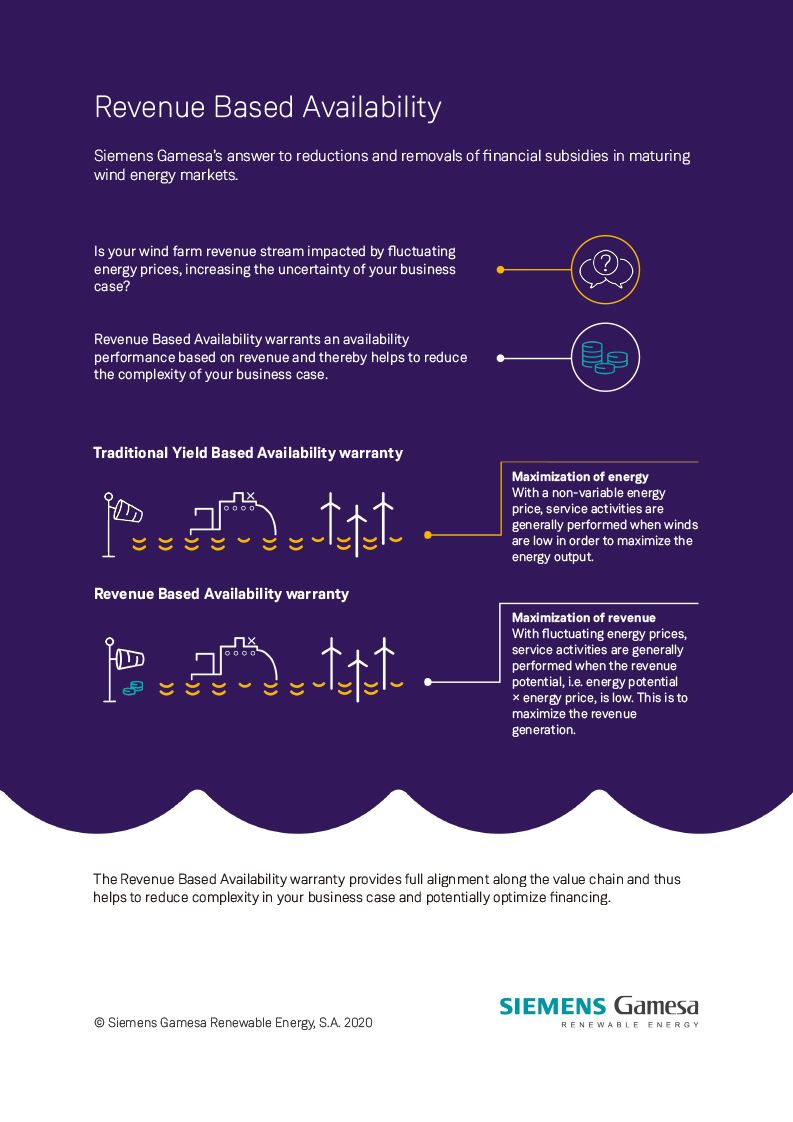

But as wind becomes cost competitive, the subsidy schemes that were created to foster the green transformation of our electricity systems and to create jobs are naturally winding down, especially in mature markets. The discussion starts to shift in another direction: how can our customers extract the most value or revenue out of every produced KW hour?

If they continue to exclusively pursue yield-based availability (YBA) in a spot or mature market environment, their assets will operate, their turbines will spin, but their profits will diminish – it’s like running an empty taxi around New York City all the time

The US is a good example, actually: you will begin to see onshore projects there that will basically become insolvent because their running costs will start equaling out or in some cases even dipping below their projected revenues.

Of course, we need to be smarter and think differently about how we employ and deploy service technicians, but this won’t be fundamentally difficult for us. Instead of using just a weather forecast to dispatch our service technicians, we now use a spot market price forecast and a weather forecast.

A: In a fixed tariff situation, the only variable that you’re optimizing for is production. But when subsidies are being reduced or removed, wind farm owners are forced to rethink their business models in order to deal with a variable that’s not so predictable.

We’ve seen that they will most likely go for a mix of a fixed private power purchase agreement (PPA) and a certain degree of open market pricing. Some customers are looking for a 50/50 split, others 75/25 in favor of the fixed PPA. The reason for the split is that customers are interested in harvesting the benefits from both.

Some of the largest offshore tenders come out with an expectation of zero subsidy bids. If our customers are interested in making these bids, then they need the assurance that they get from us through an RBA. A common effort is required to meet the needs of the market, and at Siemens Gamesa we stand ready to help with a viable solution.